Personalized Auto Insurance Calculator

Get a real rate based on your vehicle, driving record, and available discounts.

Smart Auto Insurance Premium Calculator with Real-Time Quotes

Our advanced auto insurance calculator provides accurate premium estimates using comprehensive risk analysis. Calculate costs based on vehicle make/model/year, driver demographics (age, gender, marital status), annual mileage, coverage selections (liability limits, collision, comprehensive, uninsured motorist), deductible amounts ($250-$2500), and available discounts (multi-policy, good driver, safety features, anti-theft devices). Compare liability insurance costs, collision coverage premiums, comprehensive insurance rates, and uninsured/underinsured motorist protection. Get instant car insurance quotes for sedans, SUVs, trucks, sports cars, and luxury vehicles. Factor in teen driver costs, senior discounts, and low mileage savings.

Related Insurance Calculator Keywords and Topics:

- auto insurance premium calculator

- car insurance cost calculator

- vehicle coverage estimator

- liability insurance calculator

- collision coverage calculator

- comprehensive insurance rates

- deductible comparison tool

- multi-car discount calculator

- good driver discount

- safe driver savings calculator

Why Use Our Auto Insurance Calculator?

- Free, instant, and accurate insurance premium estimates

- No personal information required - completely anonymous

- Compare multiple coverage options side-by-side

- Industry-leading calculation algorithms and rating factors

- Mobile-friendly responsive design for calculations on-the-go

- Save, print, and share your insurance quote results

- Expert guidance and educational resources included

- Updated regularly with latest insurance industry data

← Swipe to see all calculators →

❓Frequently Asked Questions

How accurate is the auto insurance calculator?

Our calculator uses industry-standard rating factors and algorithms to provide estimates typically within 10-15% of actual quotes. Accuracy depends on the completeness of information provided. Final rates from insurers may vary based on their specific underwriting criteria and available discounts.

What information do I need to calculate auto insurance costs?

You'll need your vehicle's make, model, and year; driver information including age, gender, and marital status; your driving record details; desired coverage types and limits; deductible preferences; and information about available discounts like multi-policy, good driver, or safety features.

Why do auto insurance rates vary by vehicle type?

Insurance rates vary by vehicle because different cars have different risk profiles. Factors include repair costs, safety ratings, theft rates, performance capabilities, and historical claim data. Sports cars typically cost more to insure than sedans, while vehicles with advanced safety features may qualify for discounts.

How can I lower my auto insurance premium?

Lower your premium by increasing your deductible, bundling policies, maintaining a clean driving record, taking defensive driving courses, installing anti-theft devices, qualifying for low-mileage discounts, choosing vehicles with good safety ratings, and regularly comparing quotes from multiple insurers.

What's the difference between collision and comprehensive coverage?

Collision coverage pays for damage to your vehicle from accidents with other vehicles or objects. Comprehensive coverage protects against non-collision events like theft, vandalism, fire, weather damage, and animal strikes. Both are optional but typically required if you have a car loan.

Do I need to provide personal information to use this calculator?

No. Our calculator is completely anonymous and requires no registration, email address, or phone number. All calculations happen in your browser, and no personal contact information is collected or stored.

How often should I recalculate my auto insurance needs?

Recalculate annually, when you purchase a new vehicle, after major life changes (marriage, moving, adding teen drivers), when your driving record changes, or before your policy renewal to ensure you're getting the best rate and appropriate coverage.

What liability coverage limits should I choose?

Minimum recommended liability coverage is 100/300/100 ($100K per person injury, $300K per accident injury, $100K property damage). Consider higher limits like 250/500/100 or 500/500/100 if you have significant assets to protect. State minimum requirements are often insufficient.

Does my credit score affect auto insurance rates?

Yes, in most states insurers use credit-based insurance scores as a rating factor. Better credit typically results in lower premiums because statistical data shows a correlation between credit history and claim frequency. Some states prohibit this practice.

What discounts can reduce my car insurance premium?

Common discounts include multi-policy (bundling home and auto), good driver (clean record), good student (for young drivers with B average or higher), low mileage, safety features (airbags, anti-lock brakes), anti-theft devices, defensive driving course completion, and paid-in-full discounts.

Don’t Miss These!

Explore Topics

Why Choose Our Auto Insurance Calculator?

✓100% Free & No Registration

All our insurance calculators are completely free to use with no hidden fees, no registration required, and no obligation to purchase.

✓Accurate Industry Algorithms

Our calculators use industry-standard rating factors and algorithms trusted by insurance professionals nationwide.

✓Instant Results & Comparisons

Get immediate premium estimates and compare multiple scenarios side-by-side to find the best coverage options.

✓Privacy Protected

Your privacy matters. Use our calculators anonymously without providing personal information or contact details.

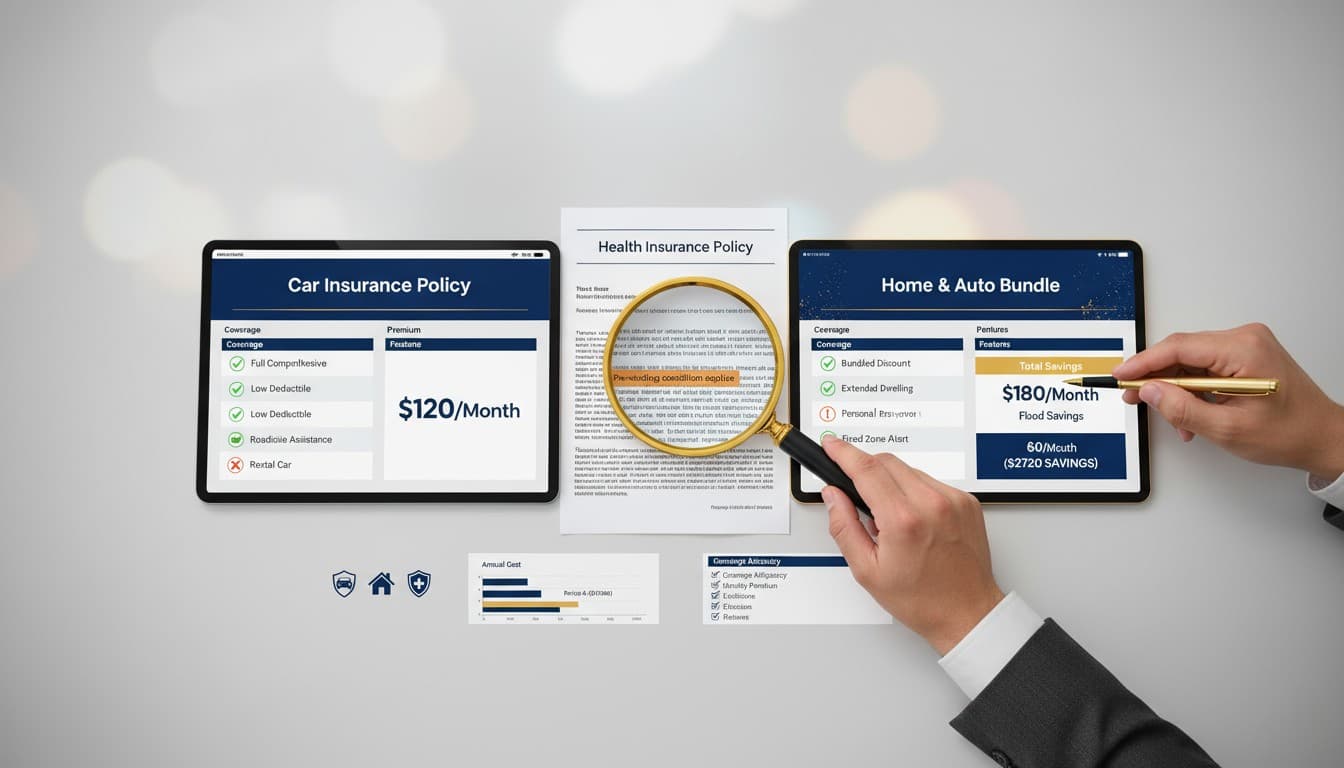

6 Essential Steps to Save Hundreds on Insurance (Without Sacrificing Coverage)

Discover 6 proven steps to shop for insurance smartly, compare quotes effectively, and save hundreds annually without compromising your coverage.

6 Steps to Compare Insurance Policies Like a Pro in 2025

Learn 6 proven steps to compare insurance policies properly. Avoid hidden costs, spot bad companies, and find coverage that protects you.

Cut Insurance Costs Fast: 8 AI Tools Saving People $400+

Discover 8 AI-powered insurance tools that cut costs, speed up claims, and save you $400+ yearly. Real examples, zero fluff.

The 43-Day Shutdown: What Just Happened and What You Need to Do Now

President Trump proposes redirecting ACA subsidies to direct payments on day 39 of shutdown. Airlines cancel 1,500 flights amid federal staffing crisis.

NAIC Summer 2025: Actuarial Guideline 55 and AI Oversight Reshape Insurance Compliance

The NAIC Summer 2025 meeting formalized AG 55 for life reinsurance, intensified offshore scrutiny, and advanced AI evaluation tools—reshaping compliance for the $3.2 trillion insurance industry.

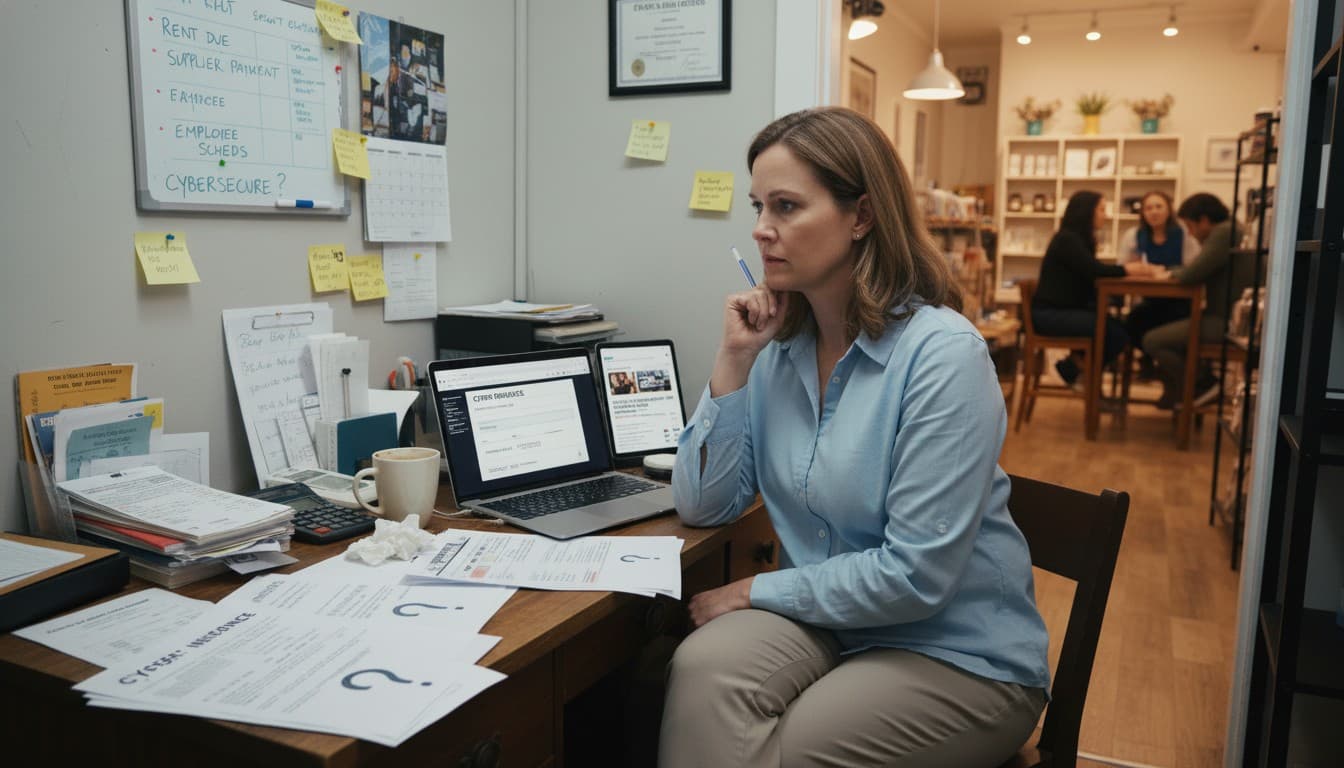

Cyber Insurance Premiums Stabilize in 2025 But Small Business Adoption Remains Stubbornly Low

Only 5-10% of small businesses have cyber insurance in 2025. With ransomware targeting SMEs and rates stabilizing, why won't the protection gap close? Expert analysis.