Comprehensive Life Insurance Needs Analysis

Use our guided wizard to determine the right coverage amount for your family.

Professional Life Insurance Needs Calculator Using DIME+ Analysis Method

Determine optimal life insurance coverage with our expert DIME+ needs analysis calculator. Calculate comprehensive protection based on: Debt (mortgage balance, auto loans, credit cards, student loans, personal loans), Income replacement (annual salary multiplied by years of support needed, typically 5-10 years for dependents), Mortgage payoff (remaining principal balance), Education funding (college costs per child: $100K-$250K for 4-year degree), and End-of-life expenses (funeral costs $7K-$12K, final medical bills, estate settlement).

Related Insurance Calculator Keywords and Topics:

- life insurance needs calculator

- DIME method analysis

- coverage amount estimator

- term life calculator

- whole life insurance

- income replacement needs

- mortgage payoff calculator

- education funding calculator

- funeral cost estimator

- human life value calculator

Why Use Our Life Insurance Calculator?

- Free, instant, and accurate insurance premium estimates

- No personal information required - completely anonymous

- Compare multiple coverage options side-by-side

- Industry-leading calculation algorithms and rating factors

- Mobile-friendly responsive design for calculations on-the-go

- Save, print, and share your insurance quote results

- Expert guidance and educational resources included

- Updated regularly with latest insurance industry data

← Swipe to see all calculators →

⚡ Quick Start Presets

Cover Your Debts

Protect your family from financial burdens

💡 Your remaining home loan balance

💡 Total of all other outstanding debts

Running Total

$765,000

📋 Your Progress

❓Frequently Asked Questions

How much life insurance do I need?

Use the DIME method to calculate your needs: Debt (all outstanding debts), Income (annual salary × years of support needed, typically 5-10 years), Mortgage (remaining balance), and Education (college costs per child, $100K-$250K each). Add 10-20% for final expenses. Most people need 10-15 times their annual income, but individual circumstances vary based on dependents, debt, and financial obligations.

What is the DIME method for calculating life insurance?

DIME stands for Debt, Income, Mortgage, and Education. Add all outstanding debts, multiply annual income by years of support needed for dependents, include remaining mortgage balance, and factor in education costs for children. This comprehensive approach ensures your family can maintain their lifestyle, pay off debts, and achieve financial goals if you pass away.

Should I choose term life or whole life insurance?

Term life insurance provides coverage for a specific period (10, 20, or 30 years) at lower premiums, ideal for temporary needs like mortgage protection or income replacement while children are young. Whole life insurance provides lifetime coverage with cash value accumulation but costs 5-15 times more. For most people, term life offers better value for pure protection needs.

How long should my term life insurance policy last?

Choose a term length that covers your major financial obligations. Common choices: 20-30 years for young families (until children are financially independent), 15-20 years for mortgage protection, 10-15 years for remaining working years before retirement. You can ladder multiple policies (combining different term lengths) for changing coverage needs over time.

Do I need life insurance if I'm single with no dependents?

If you have no dependents, your life insurance needs are minimal. Consider coverage for final expenses ($10K-$20K), outstanding debts (student loans, car loans), and any financial obligations co-signed with parents or others. If you have significant assets or business interests, you may need coverage for estate taxes or business succession planning.

How do I calculate income replacement needs?

Multiply your annual salary by the number of years your family would need support. Financial experts recommend 5-10 years of income replacement for families with young children, adjusting for: your spouse's income potential, existing savings and investments, Social Security survivor benefits, and inflation. Consider whether your family could maintain their lifestyle with this amount invested conservatively.

Should I include college costs in my life insurance calculation?

Yes, if you want to ensure your children can attend college regardless of what happens to you. Current estimates: $100K-$150K for in-state public university, $150K-$250K for private university per child for a 4-year degree. These costs increase 5-6% annually. Include full estimated costs in your calculation, or factor in partial funding if you have existing education savings accounts.

What are final expense costs I should include?

Final expenses typically include: funeral and burial costs ($7K-$12K), final medical bills not covered by insurance, estate settlement costs, probate fees and legal expenses, and outstanding credit card or small debts. Plan for $15K-$25K total for final expenses, more if you desire elaborate arrangements or lack sufficient liquid assets to cover these costs.

How does my age affect life insurance costs?

Life insurance premiums increase with age because mortality risk rises. A 30-year-old may pay $20-$30/month for $500K term life, while a 50-year-old pays $100-$200/month for the same coverage. Lock in rates while young and healthy. Premiums are fixed for the term length, so purchasing at younger ages provides decades of lower rates.

Can I adjust my life insurance coverage over time?

Yes, through several methods: purchasing additional policies as needs grow, converting term policies to permanent coverage (if your policy includes a conversion option), laddering multiple term policies with different end dates, or reducing coverage as financial obligations decrease. Review your coverage annually and after major life events like marriage, children, home purchase, or career changes.

Don’t Miss These!

Explore Topics

Why Choose Our Life Insurance Calculator?

✓100% Free & No Registration

All our insurance calculators are completely free to use with no hidden fees, no registration required, and no obligation to purchase.

✓Accurate Industry Algorithms

Our calculators use industry-standard rating factors and algorithms trusted by insurance professionals nationwide.

✓Instant Results & Comparisons

Get immediate premium estimates and compare multiple scenarios side-by-side to find the best coverage options.

✓Privacy Protected

Your privacy matters. Use our calculators anonymously without providing personal information or contact details.

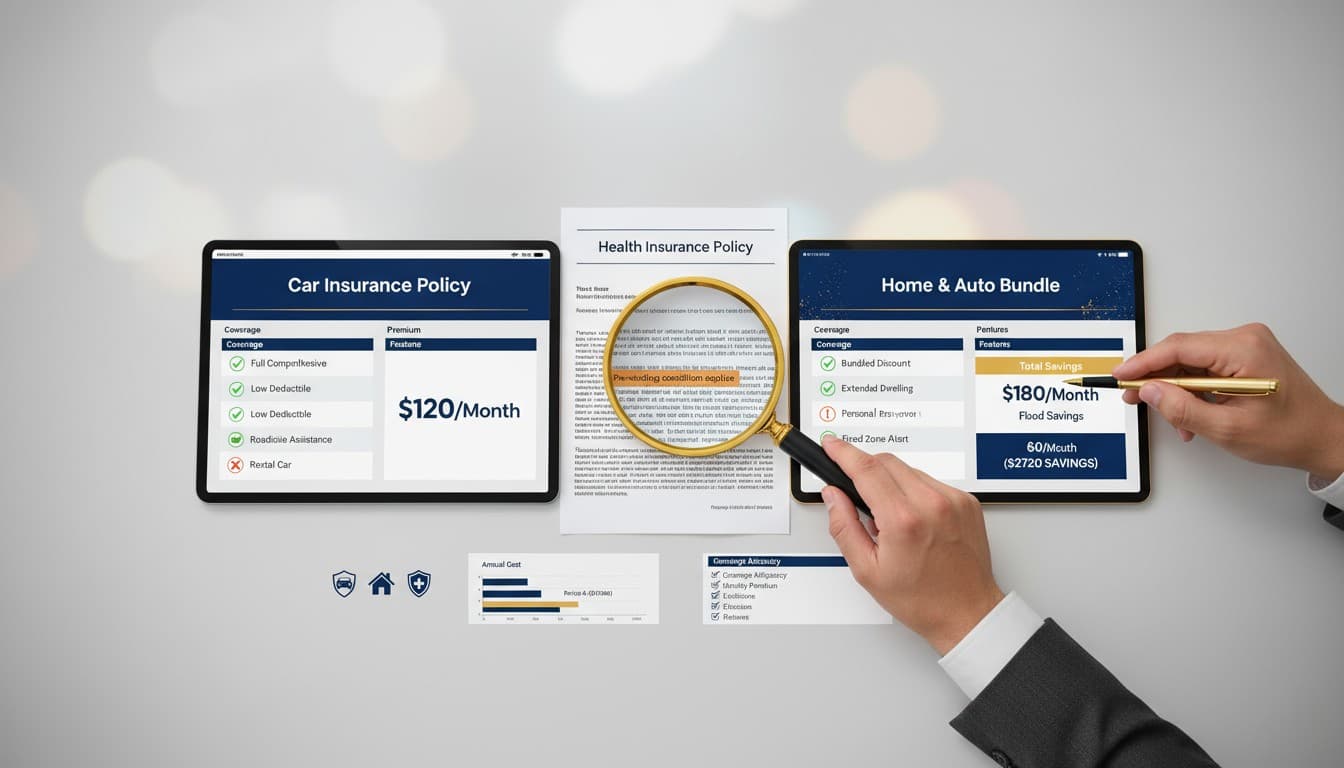

6 Essential Steps to Save Hundreds on Insurance (Without Sacrificing Coverage)

Discover 6 proven steps to shop for insurance smartly, compare quotes effectively, and save hundreds annually without compromising your coverage.

6 Steps to Compare Insurance Policies Like a Pro in 2025

Learn 6 proven steps to compare insurance policies properly. Avoid hidden costs, spot bad companies, and find coverage that protects you.

Cut Insurance Costs Fast: 8 AI Tools Saving People $400+

Discover 8 AI-powered insurance tools that cut costs, speed up claims, and save you $400+ yearly. Real examples, zero fluff.

The 43-Day Shutdown: What Just Happened and What You Need to Do Now

President Trump proposes redirecting ACA subsidies to direct payments on day 39 of shutdown. Airlines cancel 1,500 flights amid federal staffing crisis.

NAIC Summer 2025: Actuarial Guideline 55 and AI Oversight Reshape Insurance Compliance

The NAIC Summer 2025 meeting formalized AG 55 for life reinsurance, intensified offshore scrutiny, and advanced AI evaluation tools—reshaping compliance for the $3.2 trillion insurance industry.

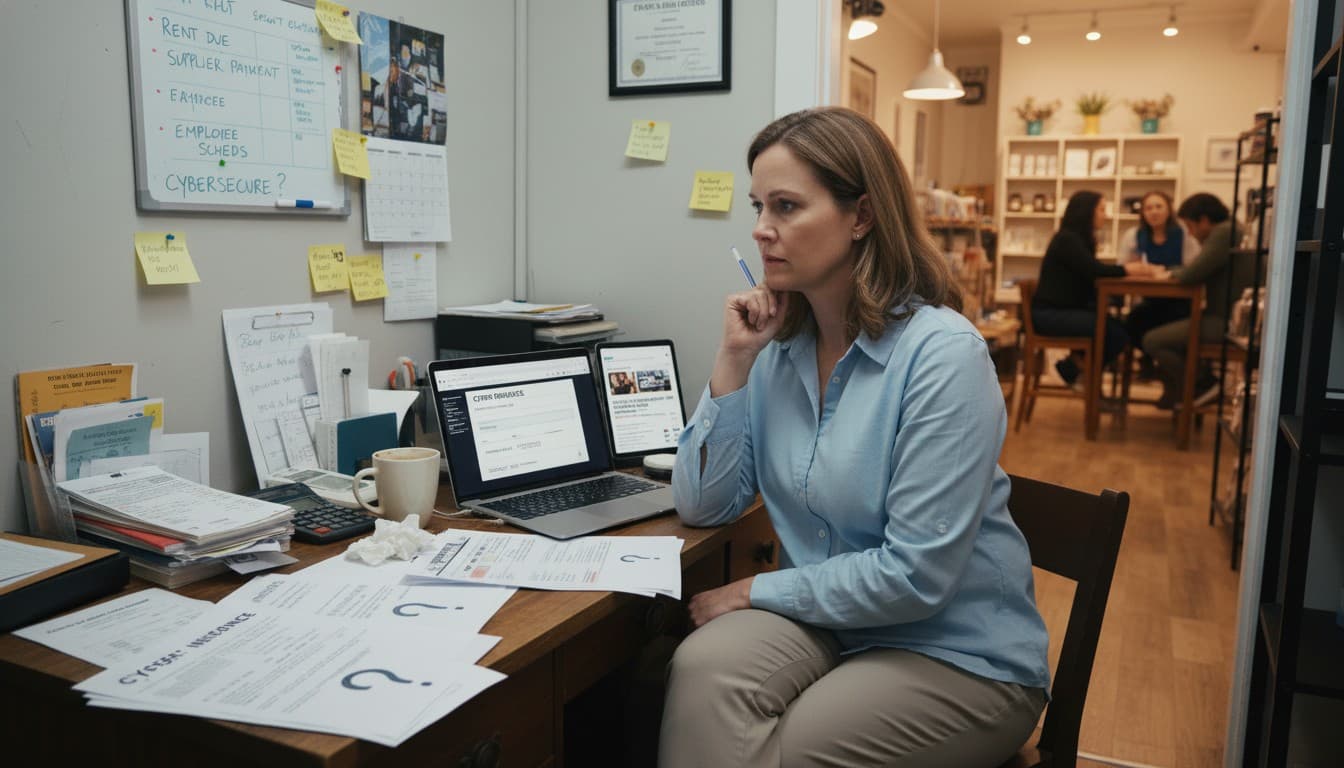

Cyber Insurance Premiums Stabilize in 2025 But Small Business Adoption Remains Stubbornly Low

Only 5-10% of small businesses have cyber insurance in 2025. With ransomware targeting SMEs and rates stabilizing, why won't the protection gap close? Expert analysis.